Patients and caregivers often ask why is there no generic insulin. The short answer is that insulin is a biologic drug, not a traditional small‑molecule medicine. Biologics require a different approval path, use live cell systems, and face unique patent and manufacturing hurdles. These factors shape names, prices, and what counts as a substitute.

Key Takeaways

- Biologics vs generics: insulin follows biosimilar rules, not classic generics.

- Patents and exclusivities complicate competition and substitution in pharmacies.

- Manufacturing complexity raises costs and limits rapid market entry.

- Interchangeable products help access, but rules vary by jurisdiction.

Why Is There No Generic Insulin

Insulin is a biologic (large, protein‑based drug) produced in living cells. Unlike chemical generics, which can be identical copies, biologics cannot be perfectly duplicated. Regulators therefore use the biosimilar and interchangeable frameworks to evaluate similarity in structure, function, and clinical performance. This is why “generic insulin” is a misleading phrase in strict regulatory terms.

Regulatory agencies assess analytical similarity, immunogenicity risk, and clinical data before approval. In the United States, the Biologics Price Competition and Innovation Act created a pathway for biosimilars and interchangeables. For a concise overview of biosimilar standards, see the FDA biosimilars overview, which summarizes evidence expectations and pharmacy substitution rules (FDA biosimilars overview).

Biosimilars, Interchangeables, and Naming

Today’s insulin market includes reference products and biosimilars. Interchangeable biosimilars can be substituted at the pharmacy in some jurisdictions. Naming reflects this difference: many biosimilars carry a core nonproprietary name plus a suffix. This clarifies pharmacovigilance (safety tracking) and helps prevent dispensing errors.

Patients often frame the issue as generic insulin vs branded insulin. Clinically, biosimilars must demonstrate no clinically meaningful differences from the reference product. Still, each product has its own label, supply chain, and device platform. For definitions and examples, see Biosimilar Insulin, which outlines how insulin biosimilars enter care pathways and what evidence supports switching for patients (Biosimilar Insulin).

Patents, Exclusivity, and Market Dynamics

Multiple layers protect insulin brands beyond a single composition patent. Device designs, delivery mechanisms, manufacturing processes, and formulation tweaks can extend exclusivity. These layers influence how and when competitors launch, and whether substitution is allowed at the pharmacy counter.

Patients sometimes ask is insulin patented. The science behind insulin has a long history, but modern formulations, pens, and processes remain protected in many regions. Even when patents expire, regulatory data exclusivity and device ecosystems can sustain brand differentiation. This environment affects competition, contracting with payers, and what options reach specific formularies.

Manufacturing Complexity and Costs

Biologics require living cell lines, specialized purification, and rigorous quality controls. Small changes in culture conditions can alter protein folding, glycosylation, or impurities. These realities raise capital and operating costs and reduce the number of qualified manufacturers worldwide. Scaling production while meeting stability and sterility standards is resource‑intensive.

A common question is how much does insulin cost to make. Estimates vary by product and plant, but inputs are only part of final prices. Compliance, sterile facilities, analytical testing, cold chain logistics, and post‑market safety systems all add cost. For a global market perspective, the WHO insulin market report summarizes availability, competition, and policy levers across regions (WHO insulin market report).

Pricing Trends and Access in the U.S.

List prices rose for years, drawing scrutiny from clinicians, patient groups, and lawmakers. Contracting practices, rebates, and formulary placement further complicate what patients pay at the counter. Policy actions and manufacturer programs have started to moderate out‑of‑pocket costs for some, but access remains uneven.

Media often refer to the insulin price increase scandal to describe past list‑price inflation and market consolidation. For a neutral overview of price trends and drivers, the GAO insulin prices report aggregates data across payers and time periods, helping readers separate list prices from net prices and patient copays (GAO insulin prices report). For practical comparisons across brands and formats, see Compare Insulin Prices, which compiles product‑level pricing considerations and packaging differences (Compare Insulin Prices).

Country Comparisons and Formularies

Coverage, co‑payment rules, and negotiated discounts differ widely by country. Some national systems centralize purchasing, while others rely on private plans and pharmacy benefit managers. These structures influence which products appear on formularies and which delivery devices are commonly available.

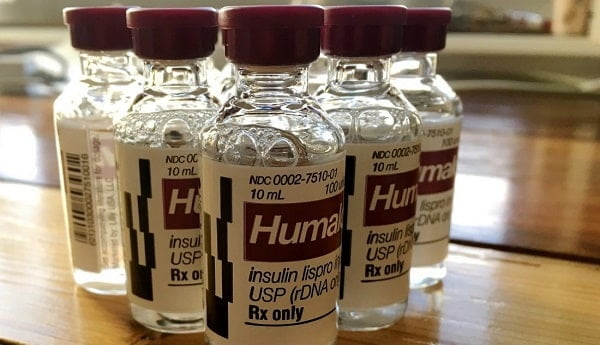

Analysts frequently examine cost of insulin by country to understand affordability gaps and policy outcomes. Exchange rates, taxes, and supply chain markups can distort direct comparisons. Patients can still use cross‑market data to frame discussions with insurers and clinicians. For brand‑specific context, Humalog Insulin Price illustrates how a single product’s costs can vary by format and plan design (Humalog Insulin Price).

Lantus, Semglee, and Interchangeability

Some long‑acting insulins share similar clinical roles but differ in naming, pens, and approval status. Pharmacies follow local laws on substitution, and insurers may prefer one product over another based on contracts. Patients should confirm device compatibility, needle type, and training needs before switching.

Clinical discussions often center on semglee vs lantus in settings where interchangeability is recognized. The FDA Semglee approval announcement explains the scientific basis for interchangeability and outlines substitution rules where permitted (FDA Semglee approval). For brand context and alternatives, see Basaglar Generic Name for a concise look at related long‑acting options and naming logic (Basaglar Generic Name). If your plan covers cartridge systems, Lantus Cartridges can illustrate device and format considerations that matter during refills (Lantus Cartridges).

Alternatives and Device Choices

When a preferred brand is excluded or costly, clinicians may suggest a therapeutically similar option. Long‑acting choices differ in onset, duration, and pen platforms. Consider training needs, vision or dexterity issues, and whether a prefilled pen or vial‑and‑syringe workflow suits daily life. Collaboration with a clinician and pharmacist helps avoid dosing confusion.

Some patients transition to another basal insulin if formulary changes occur. Device preferences play a role too. For example, Tresiba FlexTouch Pens offer a distinct pen design and dosing feel compared with other brands (Tresiba FlexTouch Pens). If a cartridge‑based system is favored, Levemir Penfill Cartridges provide an alternative platform that some patients find familiar (Levemir Penfill Cartridges). For mealtime options with pens, Humalog KwikPen shows how rapid‑acting devices vary in usability features across models (Humalog KwikPen).

Out-of-Pocket Strategies and Support

Copays depend on plan design, deductibles, and whether a brand sits on a preferred tier. Pharmacies may apply automatic substitutions if allowed, but prescribers can restrict switching on safety or clinical grounds. Manufacturer assistance or state caps can reduce monthly spending, though eligibility varies.

Patients often search for insulin prices 2024 without insurance to anticipate monthly costs. Focus on your specific product, dose, and device, then compare formats and quantities. For practical steps, Cut Insulin Costs summarizes savings tactics like comparing vials versus pens and reviewing formulary tiers with your prescriber (Cut Insulin Costs). To see where pack sizes or concentrations change the math, Compare Insulin Prices offers side‑by‑side context for common options (Compare Insulin Prices).

Safe Use, Storage, and Supply Planning

Insulin stability depends on formulation, temperature, and time in use. Always follow the product’s label for unopened storage, in‑use room temperature limits, and discard dates. Pharmacists can help align refill timing with real‑world usage and reduce waste from early discards. This planning matters when adjusting travel or seasonal routines.

Delivery devices and needles also affect safe administration. Gauge, length, and bevel designs change comfort and injection depth. For a quick overview of needle selection, BD Ultra-Fine II Syringes demonstrates common sizes used with vial‑and‑syringe regimens and offers practical packaging details for planning refills (BD Ultra-Fine II Syringes). For broader device education, BD Needles Uses explains technique points that can reduce discomfort and improve consistency in daily injections (BD Needles Uses).

Recap

Insulin does not have traditional generics because it is a biologic. Competition comes from biosimilars and interchangeables, which follow different rules and naming conventions. Prices reflect manufacturing complexity, regulatory history, and market contracts. Patients can improve access by understanding substitution rules, reviewing formularies, and comparing device formats.

Note: External links in this article provide regulatory and market context; always verify details against your current product label.

This content is for informational purposes only and is not a substitute for professional medical advice.